- On your OK Form 511 NR, you are allowed to deduct either your OK standard deduction or your Federal Itemized deductions. When you entered your Oklahoma gambling winnings and all gambling losses in the federal sections of TurboTax, the gambling losses will transfer over to the Oklahoma return as part of your itemized deductions.

- The IRS very specifically states that 'Gambling winnings are fully taxable and you must report the income on your tax return. Gambling income includes but isn't limited to winnings from lotteries, raffles, horse races, and casinos. It includes cash winnings and the fair market value of prizes, such as cars and trips.'

The information in this article is up to date through tax year 2019 (taxes filed in 2020).

Every year, people flock to casinos in hopes of hitting it big. And since sports betting has been legalized, more people are engaging in gambling than before.

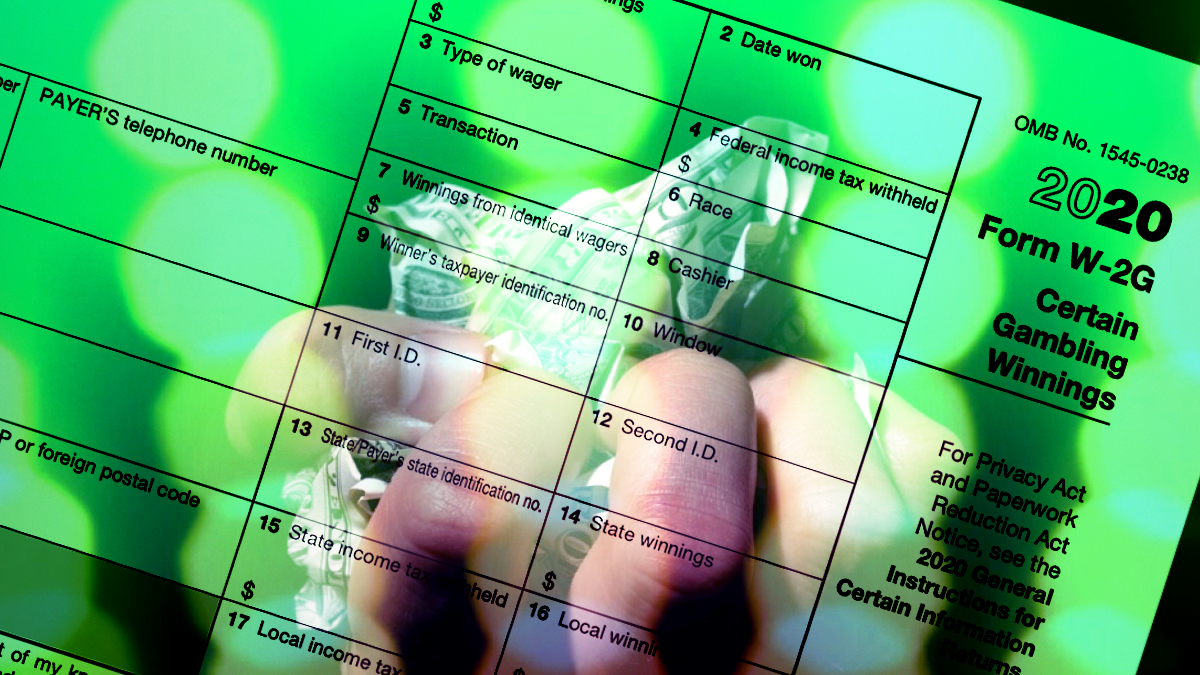

One thing to be aware of, though, is that certain winnings are taxable and are reported on IRS Form W-2 G. This document outlines your gambling winnings from a specific establishment. They should prepare the form to send to you and the IRS.

- On your OK Form 511 NR, you are allowed to deduct either your OK standard deduction or your Federal Itemized deductions. When you entered your Oklahoma gambling winnings and all gambling losses in the federal sections of TurboTax, the gambling losses will transfer over to the Oklahoma return as part of your itemized deductions.

- The IRS very specifically states that 'Gambling winnings are fully taxable and you must report the income on your tax return. Gambling income includes but isn't limited to winnings from lotteries, raffles, horse races, and casinos. It includes cash winnings and the fair market value of prizes, such as cars and trips.'

The information in this article is up to date through tax year 2019 (taxes filed in 2020).

Every year, people flock to casinos in hopes of hitting it big. And since sports betting has been legalized, more people are engaging in gambling than before.

One thing to be aware of, though, is that certain winnings are taxable and are reported on IRS Form W-2 G. This document outlines your gambling winnings from a specific establishment. They should prepare the form to send to you and the IRS.

How do I get my Form W-2 G?

W2-G Replacement Tax Forms A W2-G is an official tax document that is issued for individual jackpots and other gaming winnings over a certain amount; you should be given a copy of this form at the time the winnings are awarded. This is not the same as an annual Win/Loss Statement. If you need to request your Win/Loss statements, click here. You must report all gambling winnings as 'Other Income' on Form 1040 or Form 1040-SR PDF (use Schedule 1 (Form 1040 or 1040-SR) PDF), including winnings that aren't reported on a Form W-2G PDF. When you have gambling winnings, you may be required to pay an estimated tax on that additional income. The IRS requires U.S. Nonresidents to report gambling winnings on Form 1040NR. Such income is generally taxed at a flat rate of 30%. Nonresident aliens generally cannot deduct gambling losses.

It's the gambling establishment's responsibility to fill out and submit Form W-2 G to the IRS. The copy that you receive is for you to report on your tax return. If you haven't received your W-2 G or you lost it, contact the gambling institution to get it reissued, or contact the IRS directly since they will already have a copy.

Do I have to pay tax on my winnings?

Casino Winning Tax Form

Only winnings above a certain amount in certain games are reported on IRS form W-2 G. It is important to understand that 'winnings' refer to the net amount. So, if you wager $1,000 and win $2,000, your winnings are $1,000.

Only winnings above a certain amount from specific games will be reported on form W-2 G. Those include:

- Slot machine and bingo winnings of $1,000

- Keno winnings equal to or greater than $1,500.

- Pokertournament winnings exceeding $5,000

- Any lottery or sweepstakes winnings over $600

- Any other gambling activity in which you won 300 times the wager

Are winnings withheld for taxes?

This simple question, like most tax-related inquiries, has a complicated answer. Gambling establishments withhold 25% of winnings for individuals who have a Social Security number on file and 28% for all others. Since these winnings are included in taxable income, the individual's tax bracket ultimately determines how much is withheld.

Can I deduct gambling losses?

Casino Winning Tax Form

Yes, losses can be deducted – although you won't receive IRS form W-2 G outlining losses. Keep records of your wagers and losses. They will be reported on Form 1040, Schedule A as 'Other Itemized Deductions.' Be aware, though, that the number of losses which are deductible cannot exceed the number of winnings reported on your tax return.